Buying a company’s shares today is as easy as purchasing your favorite item in a shopping mall. You can now use your trading platform to buy and sell different stocks. Like any new thing, buying your first stock may be somewhat challenging, but this article breaks down the process in a step-by-step guide.

Start your stock investment journey today by doing the following:

Open an account with a stock broker

Before owning a stock, you must first have access to the stock market, which is why you need a stock broker.

It is essential to conduct thorough research about your intended broker to ensure they can help you reach your investment goals. Some factors to consider before selecting a stock broker are the platform type, services, and trading policies.

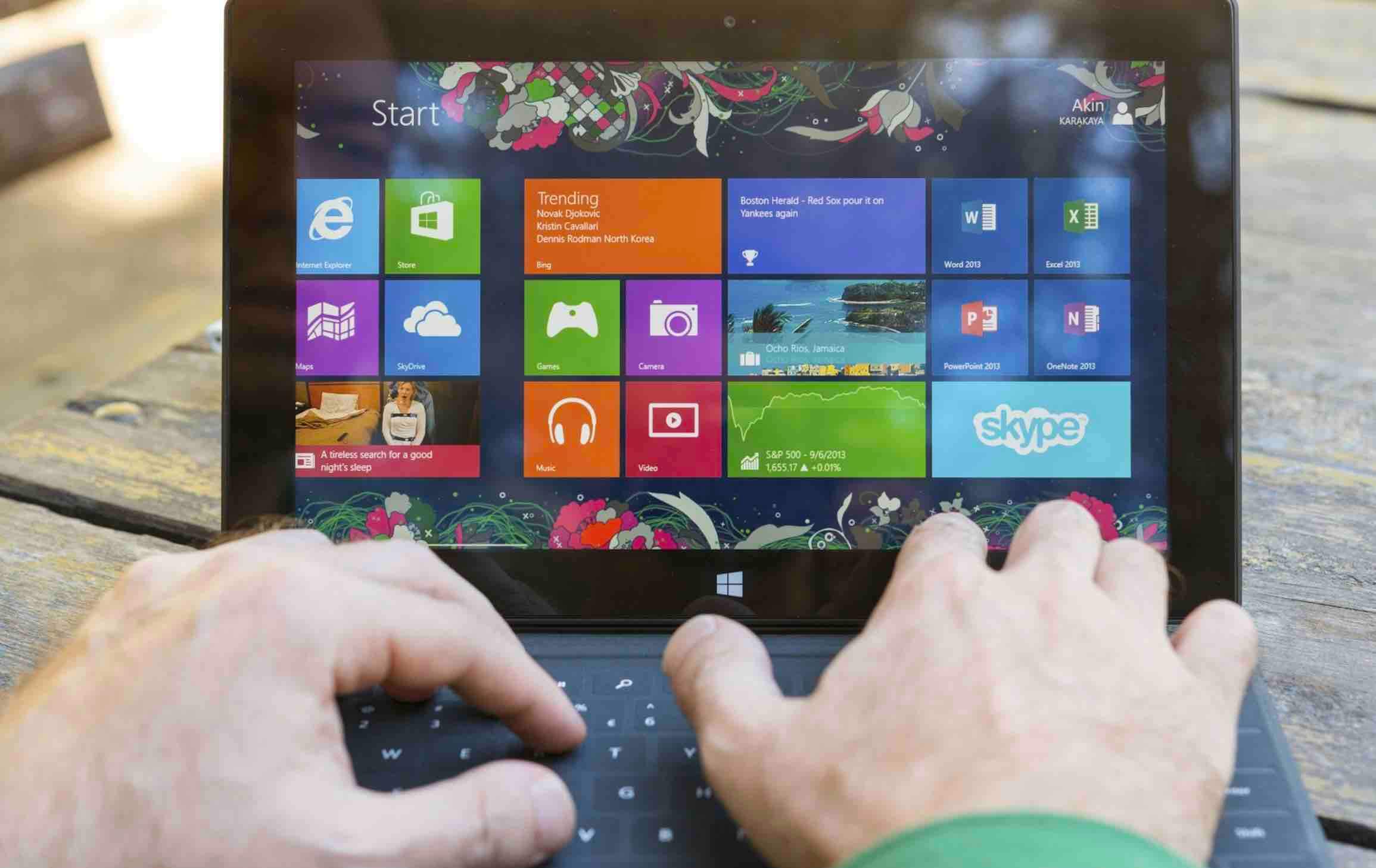

Many stock brokers today offer the option of online trading, where you buy companies’ shares via trading software or a web platform. After confirming the kind of trading platform supported by the broker, you can go ahead to open an account based on your preference.

Before settling for a Stock Broker, it is also essential to know their services and trading policies. Some platforms provide new investors with resources and materials to help them get started in the stock market. They also help you gain trading experience using play money, eliminating the risk of losing your capital while learning. As a beginner, you will find this knowledge helpful in your investment journey.

Other stock brokers may offer access to a wide range of research and analytical tools. Some even go further to provide in-person guidance or access to international stocks. Before committing with a stock broker, ensure that their services meet your unique needs.

In addition to these factors, there is also the need to look out for the usability of the trading platform, especially as a beginner. You would want a platform with a clear and navigable interface to improve your trading experience.

After choosing a suitable Stock Broker, you can complete an application for a standard brokerage account. Most online brokers will require a means of identification like social security number, international passport, or driver’s license. You will also need to include your bank information and specify if you will be funding the brokerage account via checking or savings account.

The standard brokerage account is the most common type for investing in stock, but you can also open an individual retirement account (IRA), which has been found to have more tax benefits.

Pick the stocks to buy

As a beginner in the stock market, choosing the right stocks to buy may pose some difficulty. It is advisable not to make decisions based on the current market’s move but on the “buy and hold” strategy. This method involves you buying certain stocks to own them for many years, and not because they will do well in some months to come. According to Warren Buffet, you should buy a stock with the mindset of owning part of the company as it helps you make better choices.

Now with the right mindset in place, you then conduct a little research on the companies you intend to buy their stocks. You can find helpful information about the company’s condition and chances of future success from their annual letter to shareholders/yearly reports. You can also take advantage of analytical tools like quarterly earnings updates,

SEC filings and recent news offered by your broker.

Choose the number of shares

After picking the stocks you would like to own, it is time to choose the number of shares you would like to buy. To do this, divide the amount of money you want to invest in each stock by their current price.

Some brokers offer fractional shares, which let you buy any amount of stock no matter its price, while some do not. For example, if you want to invest $1000 in a stock with a price of $122.42, let’s say Amazon (NASDAQ: AMZN). You will be buying 8.2 shares if your broker supports fractional shares, but if it doesn’t, you would only get eight shares of Amazon stock.

Stock trading on MTrading and other latest trading platforms offer fractional share options for people looking to enter the stock market with little capital. If you are a new investor, you can take advantage of this feature.

Select a stock order type

There are different conditions for buying stocks, known as the order type. These orders determine when and in what manner you trade your stocks. They are market executions and limit order.

Market execution or market order is the most common type of order for buy and hold investors. By placing this order, you are stating that you would like to buy or sell a particular stock at its current market price.

There are cases where the price you intend on buying or selling a stock changes only seconds to or during the order. It happens due to the fluctuations in the ask and bid prices of stocks.

Due to this factor, it is best to use market orders on only blue chip stocks (large and reputable companies with steady values) instead of small companies with volatile values.

A limit order, on the other hand, is a request to buy or sell a stock at a price different from its current price. This type of order gives you more control of how your trade is executed.

Let’s say a particular stock sells at $100 per share, but you value it at $95. You can decide to place a limit order to buy the stock only when it dips to your expected value. When selling, you can set a limit order only to sell your shares when the stock hits a particular high. This type of order is great for volatile stocks.

Once your order is executed, it will reflect on your portfolio immediately.

Expand your portfolio

Buying your first stock is only the first step on your investment journey. The key to becoming a successful investor is to continually take small steps towards your investment goals and expand your portfolio in the process.

Conclusion

As a new investor, one of the challenges you will face will be moments of market fluctuations. In times like this, you will be tempted to continuously monitor the performance of your stocks or even pull out of the investment race. However, you should never lose sight of the long-term goal.

As long as you believe in the values and potential of the companies in question, you can continue to hold their stocks and buy in more shares. It is the easiest way to build wealth.