Interaction between a buyer and a seller in an electronic commerce system implies payment for the purchased product or service. To ensure a high level of security in payments, it is recommended to use payment gateways that are compatible with the international PCI DSS requirements. Compliance with this standard guarantees complete confidentiality of the user’s data, such as their bank card number and secret code.

What is a payment gateway and how does it work

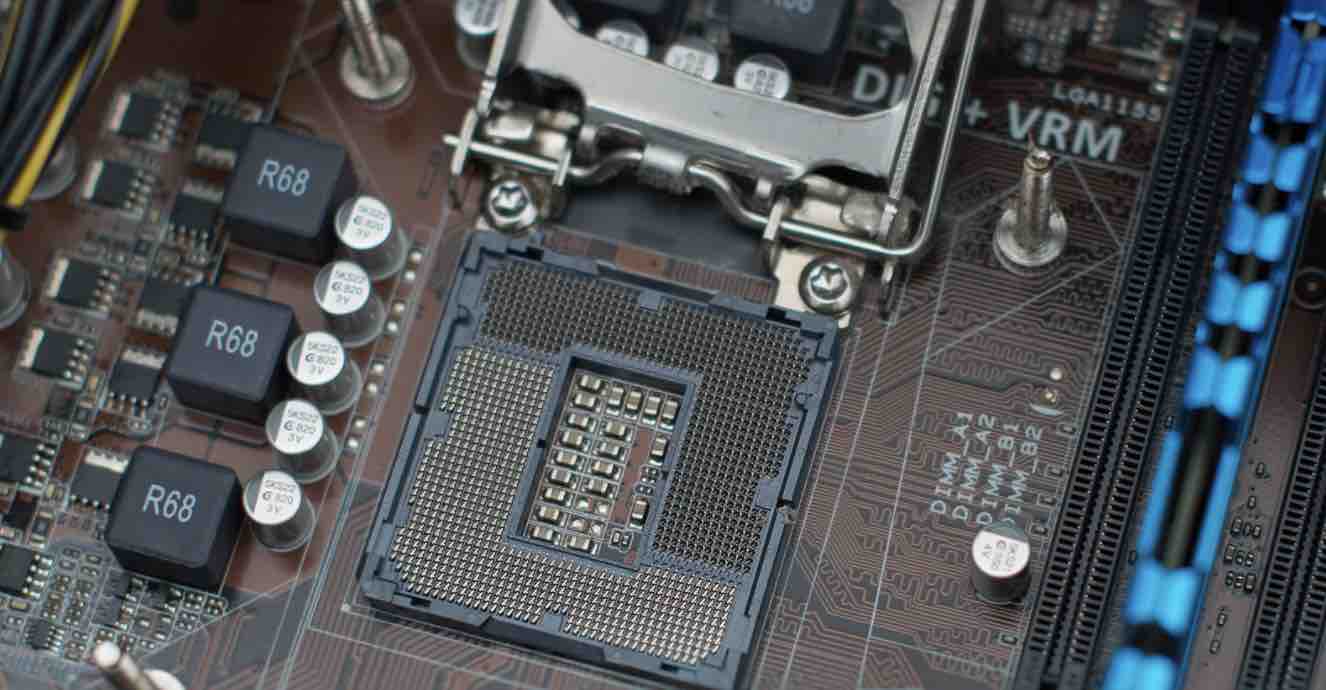

The gateway is not a payment system. It is a tool that provides a secure connection between the online store and the payment processor by encrypting information in the process of tokenizing transactions. Dedicated services provide payment gateways for e-commerce for a fee on each money transfer. The principles of the secure channel are as follows:

- The buyer of the online store decides to buy the product and pay by credit card.

- The customer enters payment details in the ordering form, which is immediately encrypted by the gateway.

- The information goes to the acquiring bank and the issuing bank, after which the information and account balance are checked with a request for authorization by the payment system.

After processing and receiving a positive response, the gateway allows the website to perform the financial transaction. The gateway itself does not participate in the transaction but provides reliable encryption of the buyer’s card information and a secure connection between the merchant and the bank.

How to choose a gateway for an online store or website

Unlike the payment system, which analyzes transaction data, the payment gateway has more advanced functionality. Using an encryption protocol, tokenization and other security measures, this tool protects confidential information, authorizes payments, and provides a connection between merchants, buyers and banks. When choosing a payment gateway, you need to consider the following points:

- PCI DSS Compliance. It minimizes the risk of third-party access to card payment information and prevents fraud.

- Functionality. You need to choose a gateway that can meet the needs of your customers and the requirements of your business.

- Commission rate. The use of payment gateways involves paying for software and transactions processing.

- Integration with other platforms. It is important that the gateway supports accounting and tax software.

- Support service. In the event of failures, malfunctions or cyber attacks, the programmer or site developer should receive a prompt response from the support of the commercial service that provides the gateway.

For the business, using a payment gateway is a profitable solution. Users of online resources themselves are quite aware of the extent to which the site is protected from fraud. Buyers prefer stores where the payment process is reliably protected from third-party access according to the PCI standard.